The end of cheaper restaurant meals pushed UK prices up last month after the Eat Out to Help Out scheme expired.

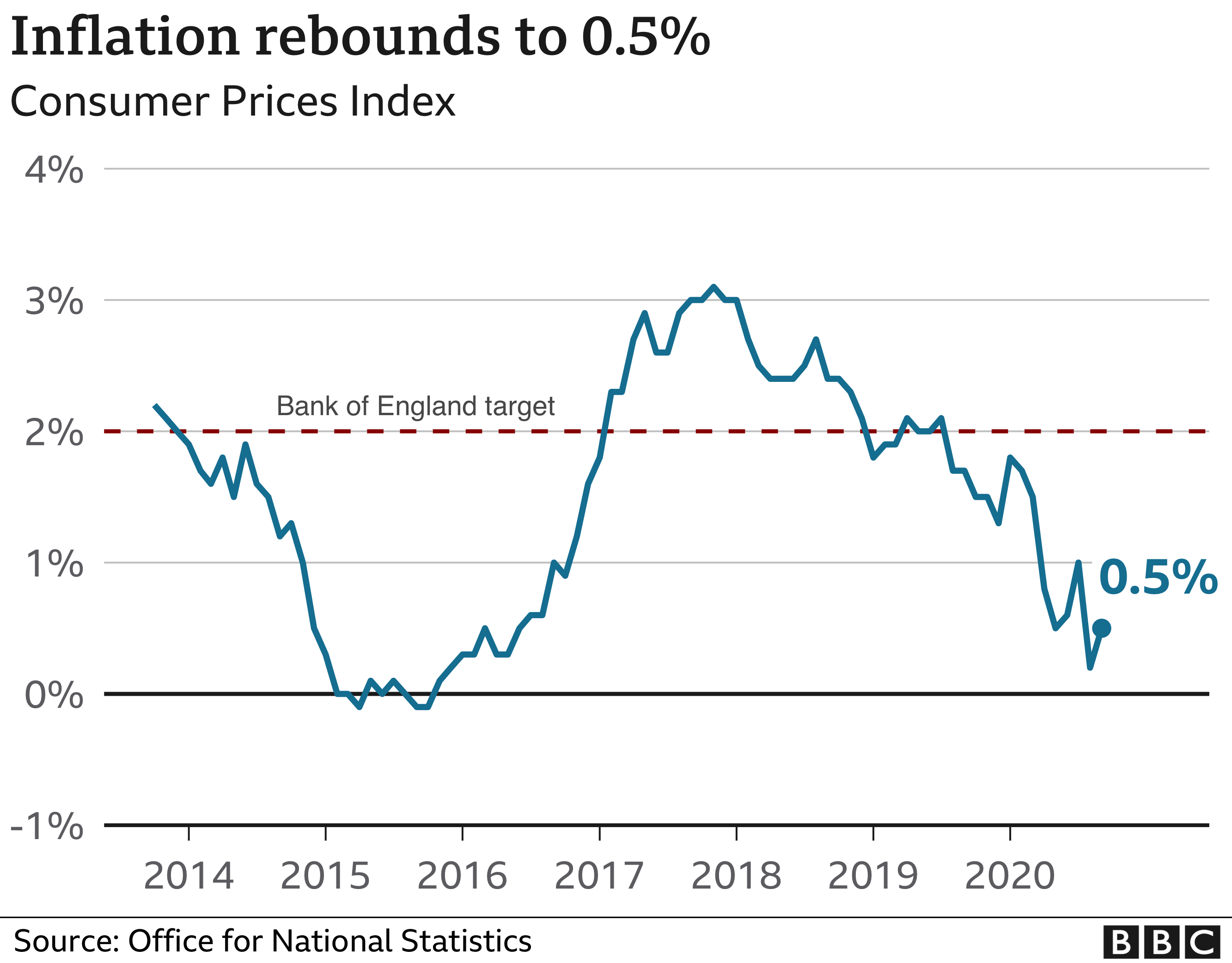

The UK’s inflation rate, which tracks the prices of goods and services, climbed to 0.5% in September, from 0.2% in August.

The Consumer Prices Index (CPI) began rising more quickly in September after the discount meals scheme ended, pushing up restaurant and café prices,

Transport costs also went up as demand for second-hand cars increased.

In catering services, prices rose 4.1% between August and September 2020, compared with a rise of 0.2% between the same two months in 2019.

Transport costs rose for the first time since March, partly because the price of second-hand cars was boosted by increased demand as people, reportedly, looked to reduce their reliance on public transport, said the Office for National Statistics (ONS).

The price of second-hand cars, climbed 2.1% between August and September 2020, compared with a 1.4% fall between the same two months a year ago.

Average petrol prices also rose to 113.3p per litre in September 2020, up from 113.1 pence in August. However, that was still some way below the 127.3p recorded in September 2019.

The drop in the cost of air fares usually seen in the September inflation index had much less effect this year, according to Jonathan Athow, deputy national statistician for economic statistics at the ONS.

“Air fares would normally fall substantially at this time due to the end of the school holidays, but with prices subdued this year, as fewer people have been travelling abroad, the price drop has been less significant,” he said.

Paul Dales, chief UK economist at Capital Economics, said that in the light of continued low inflation, the Bank of England was likely to increase its monetary stimulus measures next month to boost the ailing economy.

“With CPI inflation just 0.5% in September, it’s hard to think of reasons why the Bank of England won’t launch another £100bn or so of QE at the November meeting. And despite public borrowing still jumping, the government may yet spend more,” he said.

Inflation is the rate at which the prices for goods and services increase.

It affects everything from mortgages to the cost of our shopping and the price of train tickets.

It’s one of the key measures of financial well-being, because it affects what consumers can buy for their money. If there is inflation, money doesn’t go as far.

September’s CPI is used in the calculation for state pensions, but the government’s triple-lock rule means the increase will be 2.5%, as it’s the highest figure out of CPI, earnings growth for the year to July (which was actually negative), or 2.5%.

State benefits are also decided by the September inflation figure, meaning payments will rise 0.5% next April, which is far less than this year’s 1.7% increase.

The September figure is also used to decide the annual increase in business rates.

“Today’s headline rate of inflation of 0.5% signals that gross business rates bills next year for 2021-22 will increase by £159.42m in England,” said real estate adviser Altus Group.

Business rates are devolved to Scotland, Wales and Northern Ireland.

The UK state pension is expected to rise by 2.5% in April, owing to calculations guiding the government’s triple-lock promise.

With average earnings lower than a year earlier (based on official figures for May to July), and now the inflation rate only having risen slightly, the backstop of a 2.5% increase kicks in.

This follows three years of higher rises and is well down on the 3.9% increase seen in April this year.

Although it is still to be officially confirmed, it should mean:

The expected increase could reignite debate over fairness between the generations. On one hand, the rise will seem high to those who have lost jobs during the pandemic, but the UK state pension remains one of the least generous in western economies.

The age at which people now start to receive the UK state pension recently hit 66 for men and women. – bbc.com