Stock markets around the world have fallen after the boss of Moderna cast doubts on the effectiveness of vaccines against the new Omicron Covid variant.

Stephane Bancel told the Financial Times he thought there would be a “material drop” in vaccine efficacy.

The Covid variant was first detected in South Africa, and the symptoms have been mild so far.

But travel restrictions have been imposed as a precaution by places including the UK, the EU and the US.

Mr Bancel predicted that existing vaccines would be less effective in staving off Omicron, and that it would take months for drugs companies to update vaccines.

“There is no world, I think, where [the effectiveness] is the same level,” he said.

In the US, both the Dow Jones Industrial Average and the broader S&P 500 share indexes closed 1.9% lower. The tech-focused Nasdaq lost 1.6%.

The falls also follow remarks by the chairman of the Federal Reserve suggesting that the emergence of the new variant would worsen uncertainty around the economic recovery and inflation.

In response to a question, Mr Powell also said it was time to retire the term “transitory” which he has used to describe recent high rates of inflation. The Federal Reserve should consider tapering bond purchases more quickly, the first step towards raising interest rates, he added.

The US market falls followed similar declines in Europe and Asia.

The UK’s FTSE 100 share index, Germany’s Dax, and France’s Cac 40 slipped more than 1.5% each before regaining ground, while the pan-European Stoxx 600 lost 1.5%, hitting its lowest level in nearly seven weeks.

Tokyo’s Nikkei index closed down 1.6%, crude oil prices fell nearly 3%, and the Australian dollar hit a one-year low.

There was also a scramble for assets that are considered to be safer in times of uncertainty, such as gold, German government bonds, and the yen.

“It’s not good news, and it’s coming from someone who should know,” said Commonwealth Bank of Australia currency strategist Joe Capurso. “Markets have reacted in exactly the way you’d expect them to.”

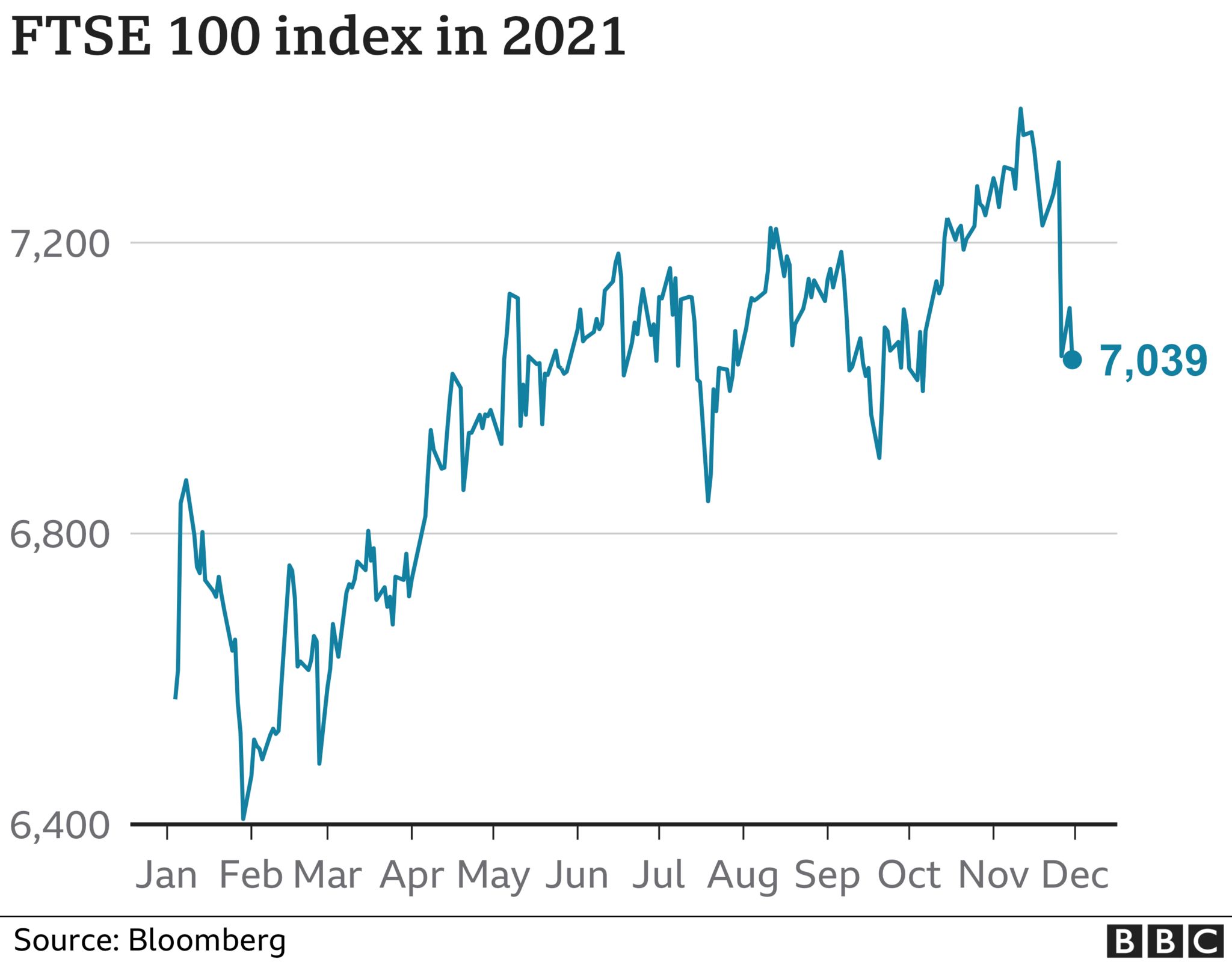

Markets plunged on Friday after investors were rattled by the discovery of the new variant, with the FTSE 100 index suffering its biggest drop in more than a year.

Stock markets rebounded slightly on Monday, but are still far below last week’s levels.

However, both the FTSE 100 and the FTSE 250, which is more focused on UK firms, are still substantially higher than this time last year – up about 8.3% and 9.6% respectively.

Big shifts in the stock market are often in the news, whether they are booms or falls owing to coronavirus or the financial crisis.

There are good reasons why this performance affects your life and finances.

There are millions of people with a pension – either private or through work – invested by pension schemes.

The value of their savings pot is influenced by the performance of these investments.

Timing is more critical for those at retirement age, as this may be when a retiree uses their pension pot to buy a retirement income, or annuity.

The bigger the pot, the more income they will get in retirement.

Uncertainty about the new variant has triggered global alarm, with border measures casting a shadow over the economic recovery from the Covid pandemic that has been taking place.

It comes as infections rise again in some European countries.

However, European Medicines Agency (EMA) executive director Emer Cooke told the European Parliament that even if the new variant becomes more widespread, existing vaccines should continue to provide protection.

Andrea Ammon, who chairs the European Centre for Disease prevention and Control (ECDC), said 42 cases of the variant had been confirmed in 10 EU countries. There were another six “probable” cases.

She said the cases were mild or without symptoms, although in younger age groups.

The science may still be uncertain but the Omicron variant has definitively intruded upon recent stock market euphoria.

The designation as a variant of concern last week, and then further comments this morning from vaccine makers that existing vaccines will not be as effective, has caused widespread and significant falls in share prices.

So what will the economic effect be? It should be limited and that is mainly because it’s clear that the UK Government and the US Government will do everything to avoid any further lockdowns.

The world awaits the health data from hospitals, first from South Africa’s outbreak, and then elsewhere, about its transmissibility and severity.

The new restrictions announced here in the UK and around the world reflect real time science, and in particular an expectation that the variant takes some bricks out of the wall of vaccine immunity.

That in and of itself will have some economic impact. In the UK, real time data from restaurant reservations and online job adverts were well above the equivalent day last year. Retail footfall was just 8% below the equivalent day in 2019. Things were beginning to get back to normal, even with a considerable number of Delta cases, and a steady stream of weekly deaths.

Omicron has paused some of this process, merely by injecting a doubt that the pandemic is behind us.

The World Health Organization has said it could take weeks to determine how severe Omicron infections could be, and how much protection current vaccines give.

The University of Oxford said there was no evidence that current vaccines would not prevent severe disease from Omicron, but that it was ready to rapidly develop an updated version of its shot with AstraZeneca, if that is necessary.

Moderna and fellow drugs firms BioNTech and Johnson & Johnson are working on vaccines that specifically target Omicron in case existing shots are not effective against it.

Moderna has also been testing a higher dose of its existing booster. – bbc.com